The gospel of infinite prosperity is back in full bloom. Echoing from the television talking heads and radio pundits preach that the economy is on the mend because we have spent our way into prosperity. This recovery, as we are led to believe, is occurring even though jobs are being lost at the rate of 2.5 million a year and this is somehow good (or less bad in their words). We are now led to believe that jobless recoveries are simply part of the new economic landscape. This coming from a group of people that missed the largest recession since the Great Depression (maybe they should avoid predictions for a few years). Since the recession started in December of 2007, a painful 20 months indeed, the U.S. economy has shed 6.9 million jobs. That is the official number. If we dig deeper, we have 26.3 million unemployed and underemployed workers in the economy. For a recession that is the “worst since the Great Depression” we sure got out of it fast.

Getting out of it fast is what we are being led to believe. Yet the public is being fed a bunch of nonsense from the gospel of infinite prosperity. Much of this philosophy was also part of the Roaring 20s. The near religious belief in the big business culture of the U.S. Of course, much of this has influenced the way the crony capitalist have infected Wall Street with their cannibalistic method of destroying wealth for the country for short-term gain. The notion that spending trillions of dollars and giving authority to those that have led us to financial Armageddon is perverse as it is backwards. If anything, it simply demonstrates that Washington and Wall Street are wedded at the hip while ignoring the plight of the average American.

For a country that talks about the “small business owner” the reality is much different. During this economic crisis it is the mighty who are receiving the biggest handouts. You don’t see Jim’s local hardware shop getting a bailout. But Bank of America, Wells Fargo, and JP Morgan all received their piece of the economic handout. And look at all the bank failures. In relative terms, the small are being allowed to implode. In reality, they hold very little of the banking wealth. The U.S. currently has 8,195 banking institutions according to the latest FDIC report. 116 institutions or slightly above 1 percent own and control 77 percent of all banking assets.

And wealth inequality is at record levels once again:

Source: William Domhoff

81 percent of all financial wealth is concentrated with the top 10 percent. If you are wondering about another time in history when so much wealth was concentrated in a few hands you can look to the Great Depression. Even though the punditry proclaims to believe in the middle class the data paints a very different picture.

In today’s Lessons from the Great Depression series we are going to examine the Roaring 20s. Much like our economic climate today, much of the “success” was confined to a small group. Sure, many lived up the good times like during our HELOC housing bubble mania but once the tide went out, people learned a quick lesson between wealth and income. Income can be taken away rather quickly as many people are now realizing. Wealth on the other hand has longer sustainability and can impact control including favorable policies enacted by lobbyist to protect the unequally weighted status quo.

This is part XXVIII in our Lessons from the Great Depression series:

I’ve studied the Great Depression in great detail. Some of the best books on the topic include:

Only Yesterday by Frederick Lewis Allen

The Great Crash of 1929 by John Kenneth Galbraith

The World in Depression by Charles Kindleberger

Today I’ll be focusing on a few passages from The Year of the Great Crash 1929 by William Klingaman. People think of the Roaring 20s with images from the privileged elite that may come from F. Scott Fitzgerald’s Gatsby like literature. Yet the reality is very different. What we find is a nation that shuns savings, spends on credit, cuts deep in to the working class, and ultimately leads the nation into financial Armageddon:

“Beneath all the sanctimonious probusiness rhetoric, the Coolidge boom was based upon the tremendous expansion in productive capacity of American factories in the 1920s, particularly in such basic industries as iron, steel, petroleum, chemicals, and light metals. Because America’s fundamental transportation and manufacturing systems had been completed before 1914, and because the war had suddenly thrust the United States into an entirely unfamiliar role as a creditor nation possessing a record-breaking stock of European gold, businessmen were free to turn their attention toward refinements in the production and distribution processes. Spurred by military demands during the war, and sustained by the adoption of scientific management techniques in the years immediately afterward, U.S. industrial production nearly doubled between 1919 and 1929. Automobiles production skyrocketed; by 1929, Detroit was turning out nearly five million new cars a year.”

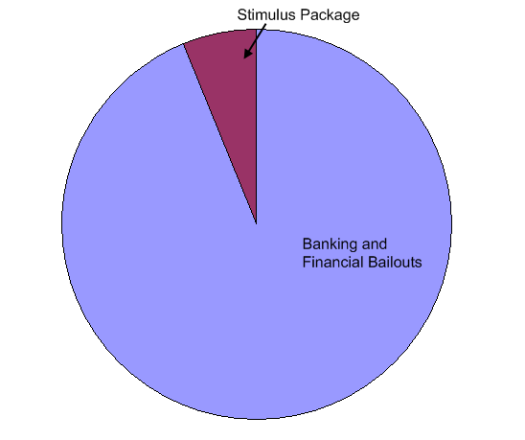

America is anything but a creditor nation. We are a nation full of debt. The green shoot argument was based on spending money we didn’t have. The use of Keynesian philosophy in such a poorly managed way is disturbing. It would be one thing if the bulk of the money was spent on average working Americans but the vast amount of bailout funds went to the top 10 percent while the middle class is seeing the American dream largely disappear. If you want to see a current breakdown of the current bailouts, this is how it would look:

How the stimulus package can garner more heat when we have given the banking and financial sector nearly 20 times more in funds is amazing. The crony capitalist have figured out a way to get the public to focus on smaller shiny things while ignoring the massive exploitation of fraud going on.

To think that suburban sprawl is only a thing from our current housing bubble is incorrect:

To think that suburban sprawl is only a thing from our current housing bubble is incorrect:

“Highway construction (funded primarily by state and local expenditures) provided thousands of new jobs; and as Americans enjoyed the benefits of increased mobility, sprawling networks of suburban development grew up virtually overnight, further fueling the building boom that also provided most of the nation’s cities with brand-new skylines, symbolized by the graceful, unadorned, and ultra-modern brick, cement, and stone skyscrapers that kept soaring higher and higher each year. Utility companies expanded their grids throughout the countryside, bringing the blessings of inexpensive electric light and power to most of rural America for the first time; power consumption in the United States increased at the rate of 15 percent a year during the decade.”

The perma-growth model was in full force back then as well. But I am certain that we protected the mom and pop shops back then right? I mean that is the story of small business:

“In a never-ending quest for efficiency and greater control over every aspect of their operations, businessmen in the 1920s became obsessed with bigness. Local utility companies merged into mammoth regional empires; nationwide chain stores such as A&P, Piggly-retail shops, and Woolworth’s squeezed out thousands of small, independent retail shops; big-city banks gobbled up defenseless competitors and turned them into branches of multitiered holding companies.”

Many things are large myths. The Roaring 20s roared for a select few until it all imploded with the Great Depression. Mega organizations ate and swallowed up small businesses like breakfast bars just like gigantic too big to fail banks are eating up smaller banks that are not too big to fail in the current recession. Even in the 1920s, pushing an anti-saving mentality was easy to do in the United States:

“Unfortunately, there was no corresponding expansion of employment or wages to accompany this boom in industrial output – which was, after all, achieved largely by the substitution of machinery for manpower. Without some powerful outside stimulus, production soon would have outpaced consumer capacity. So, to encourage a wider distribution of the mushrooming supply of goods and services, advertising became a major industry in itself. Saving was condemned as hopelessly out of fashion and almost unpatriotic; it was every American’s duty to provide himself with as many wristwatches, electric floor scrubbers, Frigidaires, Kriss-Kross razor blades, ultraviolet sun lamps, exercise machines, and canned peas as humanly possible.”

Does this sound familiar? Just replace the Frigidaires with Sony plasma TVs and every other consumer good you can squeeze into your Visa card. Only this time, we took it to another level with the home equity ATM because back in the 1920s homeownership was roughly 45 percent while this time we nearly took it to 70 percent. The home became the personal stimulus machine sanction by the U.S. Treasury and Federal Reserve. Once again spending does not equal wealth. But for those at the top, they have to find ways to keep the consumer running on the treadmill faster and faster. The birth of adverting was a good way to get this going:

“Advertising “makes new thoughts, new desires and new actions,” declared Coolidge approvingly in 1926. “It is the most potent influence in adopting and changing the habits and modes of life, affecting what we eat, what we wear, and the work and play of the whole nation.” In preaching the gospel of material abundance, advertisers received an incalculable boost from the invention and popularization of the radio; although the medium had been wholly unknown to most Americans before the war (only one American family in ten thousand owned a radio in 1920), the seemingly unlimited potential of radio captured everyone’s imagination during the twenties and revolutionize the nation’s communications and entertainment industries. The advent of installment purchasing plans provided additional impetus to consumption; all one needed to buy a new washing machine or diamond necklace was a minimal down payment. As the decade progressed, credit terms became even easier, with payment extended over longer and longer periods.”

Easy credit and media encouraging folks to buy things that are simply beyond their means. Now those in advertising understand basic rules in human psychology. People want to be loved, feel important, and take care of their family. If you can make someone feel inadequate in any of these areas and promise them that your product will take care of the void, you have a good chance of selling it.

Speaking of making someone feel inadequate, remember this wonderful ad for real estate during the boom?

How many people bought a home because of a conversation like this? I would wager that tens of thousands did because they wanted to avoid pain or be loved (both are bad reasons for making the biggest financial purchase of your life).

But the real underlying weakness could only be masked for so long:

“High-powered sales strategies only camouflaged the basic weaknesses in the American economy, however. At one end of the scale there was too much idle capital; at the other end were too many idle workers. Income and purchasing power were dangerously concentrated in the hands of a favored few:government statistics showed that 90 percent of the nation’s wealth was owned by 13 percent of the people. While the number of truly rich Americans kept rising – a study by the Federal Reserve Bank of New York revealed that there were forty thousand millionaires in the United States at the end of 1928, where there had been only seven thousand in 1914 – millions of American families remained locked outside the charmed circle of prosperity. Farm income declined steadily throughout the twenties, and unemployment kept climbing until it neared the four million mark by the end of 1928. The coal and textile industries remained depressed for most of the decade, producing pockets of appalling poverty in the South and especially in Appalachia. Federal surveys revealed that two-thirds of American families were struggling to survive on incomes below $2,500, the official minimum standard for a decent living. Lured into exorbitant installment purchases, workers watched as a growing percentage of their wages was sacrificed every week to meet mounting interest payments.”

We find ourselves in a similar predicament. All these cash for clunkers and tax credits for purchasing homes are simply a way to get people back into major debt. How many people bought those cars with cash? I would venture to say very few. In fact, many now have 5 to 7 year auto loans that will commit a certain amount of their income to a depreciating asset. Good move. And those buying homes with the tax credit? How many bought in areas where prices will continue to fall? After all, a jobless recovery is in the books and it is hard to make a 30 year mortgage payment with no job. This act of encouraging massive debt purchases in the midst of the deepest recession since the Great Depression is a page out of the Roaring 20s. Wealth does not equal debt! Those in the top 10 percent can tell you that but probably won’t. Anyone that tells you spending more than you earn or can afford is a path to wealth is out of their mind or doesn’t understand the basics of finance.

One group that is on a quick way to financial wealth are those awesome Wall Street CEOs:

CEOs’ pay as a multiple of the average worker’s pay

If this is the reward they get for leading us into economic disaster, can you imagine the pay with green shoots involved?

At a certain point the gig is up:

“In the second half of the decade, as the struggle among producers for customers grew ever more vicious, it became clear that “prosperity” was the exclusive province of big corporations, as the mortality rate among smaller businesses increased inexorably. “The business structure of the United States is undergoing a rigorous process of ‘rationalization,’” explained the managing director of the National Industrial Conference Board in early 1928, “in which many of the smaller companies find it increasingly difficult to compete with the high efficiency standards set by well-managed, large-scale enterprises.” The New York World was less enthusiastic about the trend: “In the intensive competition which is now under way, and which shows no signs of immediate abatement, only the large organizations able to apply the best that science and skill have to offer are showing satisfactory earnings. This goes far to explain what is sometimes called the ‘miracle’ of prosperity and falling prices. When the nature of this prosperity is understood its miraculous features become less evident.”

History doesn’t repeat but it does bring back stupid financial moves. I know I know, this isn’t the Great Depression. But what industry is going to lead us out of this deep funk? Are we going back to selling houses to one another while Tetris experts sell mortgage backed securities on their Bloomberg terminals on Wall Street to other foreign countries? Is that our idea of a booming economy? Do we think that putting a granite countertop on every home is the idea of a healthy economy while people max out their credit cards? If anything, during the 1920s we did produce and produced a lot. We were a creditor nation and exporter. Now we export debt and U.S. Treasuries while we spend to no end. The fact that we used the $8,000 tax credit to encourage home buying is disturbing because excessive home buying is what led us into this Great Recession!

But don’t let this get in the way of the new gospel of prosperity. Everything is fine. Just go out there and spend the money that you don’t have and wealth will magically appear. The financial elite of the country appreciate your service to their wealth building.

No comments:

Post a Comment