http://www.doctorhousingbubble.com/heisei-boom-financial-trickery-central-bank-voodoo-debt-federal-reserve-central-banks-too-big-to-fail-japan-us-bubbles/

The comparisons between the current real estate and debt debacles in Japan and the United States are hard to ignore. Not all horror stories of economic collapse follow the same script but it is hard to deny that we have incredible similarities and more mainstream articles are picking up on this trend. Take for example the current debt ceiling charade. It is amazing that we raised the debt ceiling with no subsequent changes to revenues and yet interest rates fell. Think about this on a more individual level. This is like a household who is spending beyond its means and suddenly raises its spending without any subsequent growth to income. Yet the fear spreading around the financial world still finds safety in the United States. At this point, it is better to store your money in the U.S. instead of Greece, England, Ireland, or Spain for example and the markets reflect this reality. Yet The U.S. is following a remarkably similar path to Japan’s lost two decades. As we approach our first lost decade it is important to examine what is happening on multiple fronts.

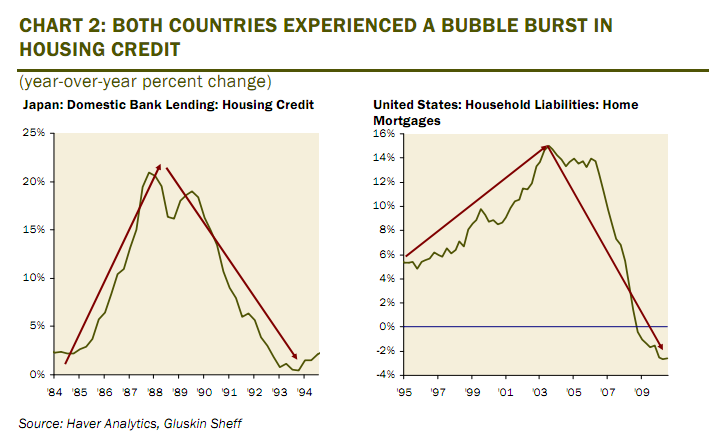

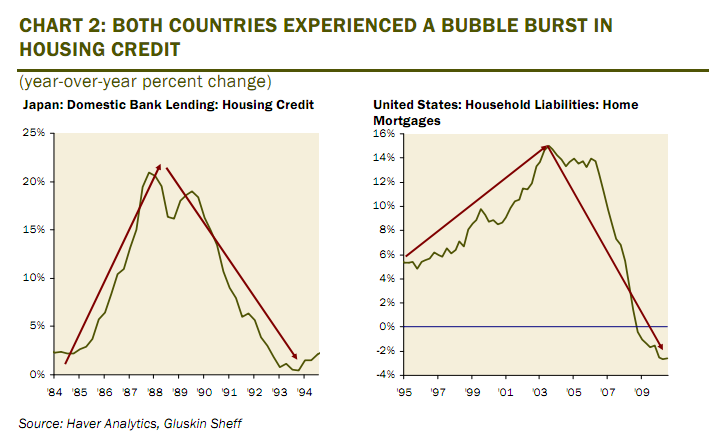

Japan and U.S. experience bubbles in home lending

Source: Gluskin Sheff

The U.S. and Japan both experienced unparalleled growth in bank lending to households to purchase real estate. In Japan this started in 1984 and collapsed in the early 1990s. In the U.S. the trend started in 1995 and collapsed in 2007. The collapse in the U.S. was actually more vicious once it hit. The only reason home prices have not contracted as severely in many areas is the emergence of shadow inventory on bank balance sheets. Japan had zombie banks and we have banks with shadow inventory but the comparison to the walking dead is very apt here. Both countries have insolvent banking systems and only through financial trickery and central bank voodoo can both systems pretend to be working. Yet both extract a toll on the productive sectors of the economy.

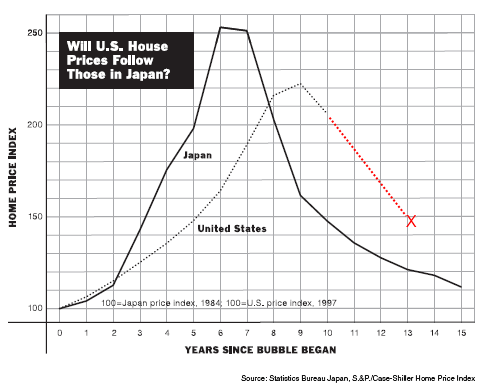

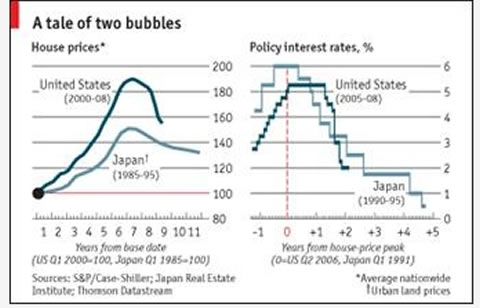

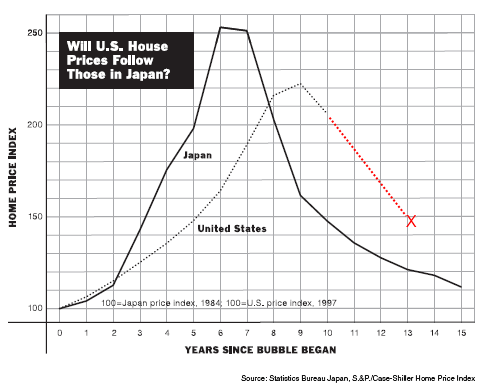

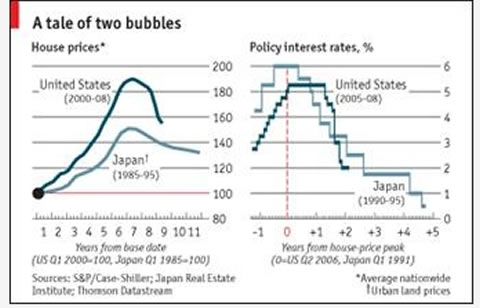

Real estate prices collapse in both countries

The collapse in housing prices has been similar in both countries and the path of each bubble seems extremely similar. For example, the above chart looks at Japan real estate starting in 1984 and aligns U.S. home prices starting in 1997. So a decade sets both bubbles apart but the path is unmistakable. Japan gave up all gains in their housing bubble bust and the U.S. housing market has yet to reach that trough. Does this mean a baseline of 1997 is where a true bottom will be reached? Hard to say yet there is little evidence to show for a rise in home prices. There is still over 6,000,000 homes in the shadow inventory that need to be liquidated at some point and will add pressure to home prices on the downside. In terms of bank housing lending collapsing and real estate values imploding we are two for two between Japan and the United States.

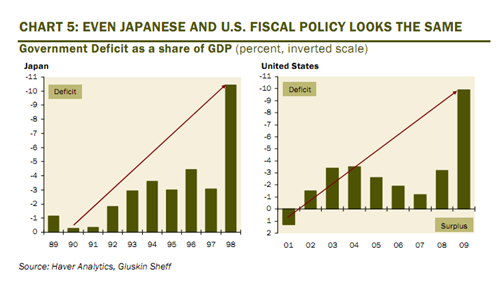

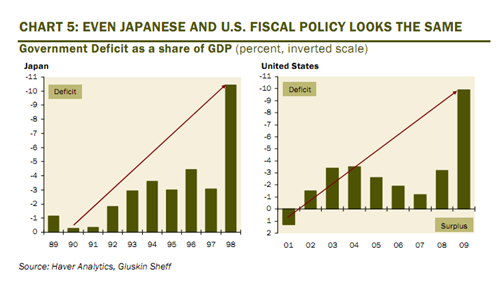

Japan and U.S. fiscal policy looks similar

Source: Gluskin Sheff

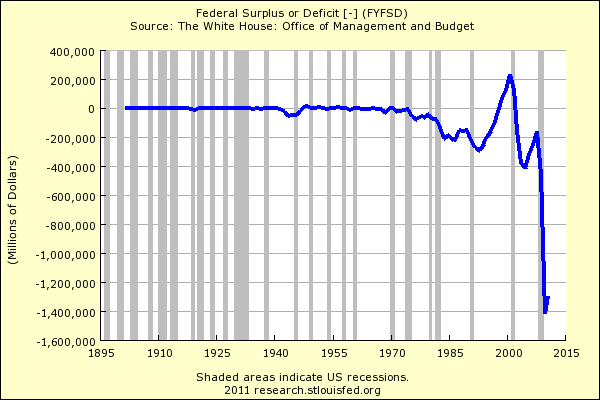

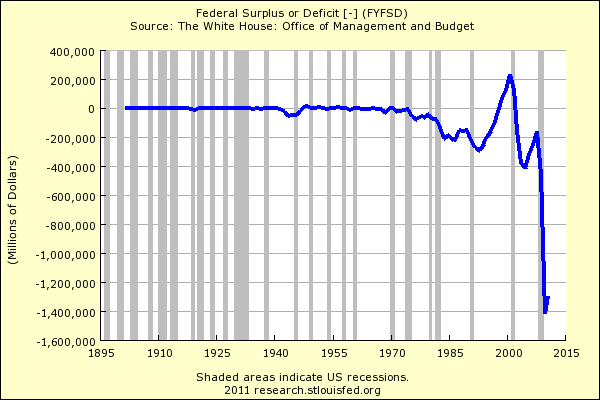

When bubbles burst a wide gap is left in the economy. Both the Bank of Japan and Federal Reserve stepped in and aided the banking systems of both countries but how well did this translate to helping the productive side of the economy? If the ultimate goal is to save the too big to fail banks then both central banks succeeded yet at what costs? Japan has now witnessed two lost decades while the U.S. is entering its first. Take a look at the above data. During the good years Japan was running a deficit of 1 to 3 percent. All of a sudden it was running deficits of 10 percent. The U.S. is running similar deficits and there is little evidence of a reversal here:

With GDP at roughly $14 trillion we are running a deficit of over 10 percent. So far the similarities between Japan’s lost decades and the United States seem to be following a very similar path.

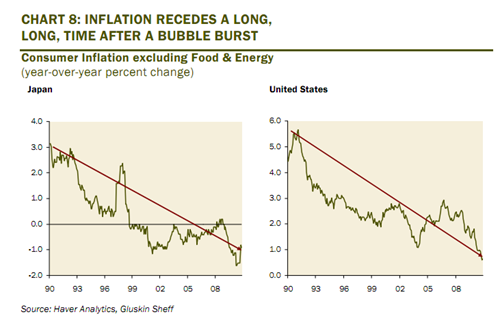

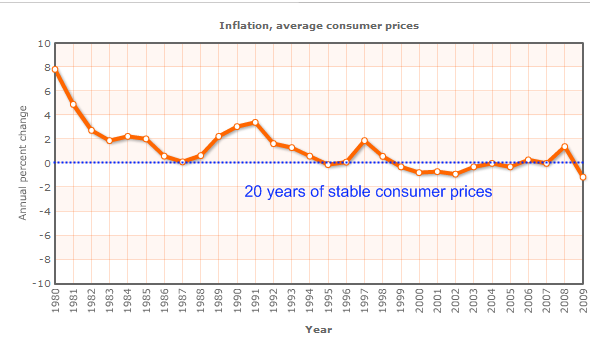

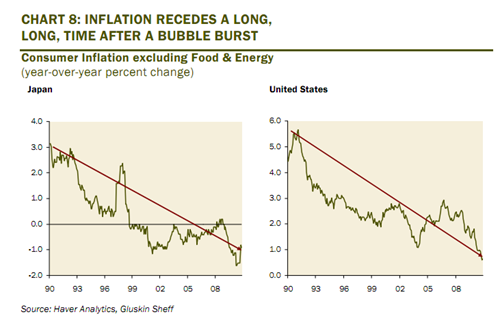

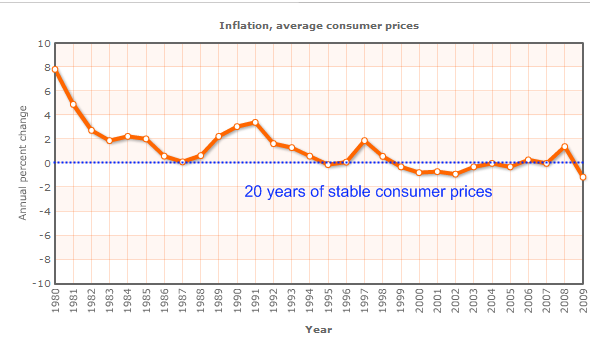

Pushing inflation lower at least as measured by government

This is an interesting pattern that is playing out here in the U.S. The crushing blow to housing has kept a lid on inflation as the economy contracts. The size of the bubble has kept inflation muted at least by how it is measured by the CPI. We’ve argued that the BLS does a very poor job at measuring the cost of housing by using an owner’s equivalent of rent but that is the system that is in place. As measured by both charts above, the bursting of the real estate market allowed each country’s central bank to save the banking system without causing dramatic inflation in the economy. Sure food, education, fuel, and healthcare went up in costs but who uses those things anyway? As measured by each government department, inflation has been contained in each country:

Part of this also has to do with the fear running through the global markets. People want to park their money in stable countries. You don’t see a rush of people buying up Greece or Spanish debt yet people are comfortable in Japanese and American debt. This is why as the debt ceiling “solution” was largely a kick the can down the road response money rushed into the U.S. markets and pushed mortgage rates even lower. Rates are so absurdly low yet this is doing very little to save the market. Why? Well we have 46,000,000 Americans on food stamps which doesn’t exactly seem like a good sign. Many Americans are first trying to deal with the employment market before trying to purchase a home.

The rise of part-time employment is also a very common theme in both countries. In Japan nearly one-third of the work force now works part-time or on a contractual basis yet is counted as fully employed. We have that similar issue here in the U.S. as our “part-time” category has shot through the roof. Headline unemployment is 9 percent but throw in the part-time looking for full work or those who have dropped out of the labor force and we have a figure above 16 percent.

Two decades of collapse

Japan is heading to a third lost decade which is hard to believe. The U.S without a doubt will have a lost decade. Even comparing stock markets we see problems ahead:

Source: Dshort.com

Japan’s Nikkei 225 index is down 78 percent from the peak reached 21 years ago! Our S&P 500 index is down 41 percent from where it was in 2000. I know many people discount the similarities between the two countries but you have many comparisons and the path each country is following is very similar:

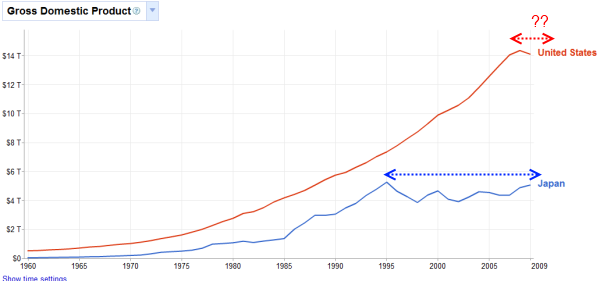

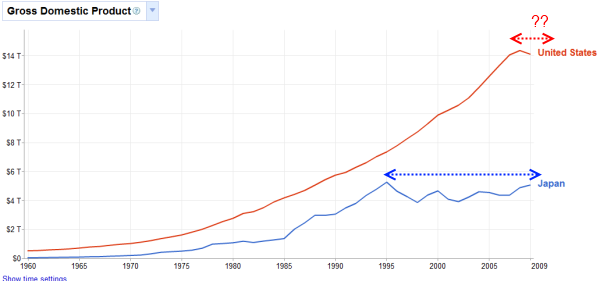

So far we’ve been in this crisis for four solid years and the path seems extremely similar with differences here and there. Japan’s multiple lost decades have hurt its overall economy:

Japan’s GDP growth has stalled since 1995. For the first time since the 1950s has the U.S. had a stall in GPD growth dragging out for four years. How much longer can this go? What similarities or differences do you see between the paths we are following?

The comparisons between the current real estate and debt debacles in Japan and the United States are hard to ignore. Not all horror stories of economic collapse follow the same script but it is hard to deny that we have incredible similarities and more mainstream articles are picking up on this trend. Take for example the current debt ceiling charade. It is amazing that we raised the debt ceiling with no subsequent changes to revenues and yet interest rates fell. Think about this on a more individual level. This is like a household who is spending beyond its means and suddenly raises its spending without any subsequent growth to income. Yet the fear spreading around the financial world still finds safety in the United States. At this point, it is better to store your money in the U.S. instead of Greece, England, Ireland, or Spain for example and the markets reflect this reality. Yet The U.S. is following a remarkably similar path to Japan’s lost two decades. As we approach our first lost decade it is important to examine what is happening on multiple fronts.

Japan and U.S. experience bubbles in home lending

Source: Gluskin Sheff

The U.S. and Japan both experienced unparalleled growth in bank lending to households to purchase real estate. In Japan this started in 1984 and collapsed in the early 1990s. In the U.S. the trend started in 1995 and collapsed in 2007. The collapse in the U.S. was actually more vicious once it hit. The only reason home prices have not contracted as severely in many areas is the emergence of shadow inventory on bank balance sheets. Japan had zombie banks and we have banks with shadow inventory but the comparison to the walking dead is very apt here. Both countries have insolvent banking systems and only through financial trickery and central bank voodoo can both systems pretend to be working. Yet both extract a toll on the productive sectors of the economy.

Real estate prices collapse in both countries

The collapse in housing prices has been similar in both countries and the path of each bubble seems extremely similar. For example, the above chart looks at Japan real estate starting in 1984 and aligns U.S. home prices starting in 1997. So a decade sets both bubbles apart but the path is unmistakable. Japan gave up all gains in their housing bubble bust and the U.S. housing market has yet to reach that trough. Does this mean a baseline of 1997 is where a true bottom will be reached? Hard to say yet there is little evidence to show for a rise in home prices. There is still over 6,000,000 homes in the shadow inventory that need to be liquidated at some point and will add pressure to home prices on the downside. In terms of bank housing lending collapsing and real estate values imploding we are two for two between Japan and the United States.

Japan and U.S. fiscal policy looks similar

Source: Gluskin Sheff

When bubbles burst a wide gap is left in the economy. Both the Bank of Japan and Federal Reserve stepped in and aided the banking systems of both countries but how well did this translate to helping the productive side of the economy? If the ultimate goal is to save the too big to fail banks then both central banks succeeded yet at what costs? Japan has now witnessed two lost decades while the U.S. is entering its first. Take a look at the above data. During the good years Japan was running a deficit of 1 to 3 percent. All of a sudden it was running deficits of 10 percent. The U.S. is running similar deficits and there is little evidence of a reversal here:

With GDP at roughly $14 trillion we are running a deficit of over 10 percent. So far the similarities between Japan’s lost decades and the United States seem to be following a very similar path.

Pushing inflation lower at least as measured by government

This is an interesting pattern that is playing out here in the U.S. The crushing blow to housing has kept a lid on inflation as the economy contracts. The size of the bubble has kept inflation muted at least by how it is measured by the CPI. We’ve argued that the BLS does a very poor job at measuring the cost of housing by using an owner’s equivalent of rent but that is the system that is in place. As measured by both charts above, the bursting of the real estate market allowed each country’s central bank to save the banking system without causing dramatic inflation in the economy. Sure food, education, fuel, and healthcare went up in costs but who uses those things anyway? As measured by each government department, inflation has been contained in each country:

Part of this also has to do with the fear running through the global markets. People want to park their money in stable countries. You don’t see a rush of people buying up Greece or Spanish debt yet people are comfortable in Japanese and American debt. This is why as the debt ceiling “solution” was largely a kick the can down the road response money rushed into the U.S. markets and pushed mortgage rates even lower. Rates are so absurdly low yet this is doing very little to save the market. Why? Well we have 46,000,000 Americans on food stamps which doesn’t exactly seem like a good sign. Many Americans are first trying to deal with the employment market before trying to purchase a home.

The rise of part-time employment is also a very common theme in both countries. In Japan nearly one-third of the work force now works part-time or on a contractual basis yet is counted as fully employed. We have that similar issue here in the U.S. as our “part-time” category has shot through the roof. Headline unemployment is 9 percent but throw in the part-time looking for full work or those who have dropped out of the labor force and we have a figure above 16 percent.

Two decades of collapse

Japan is heading to a third lost decade which is hard to believe. The U.S without a doubt will have a lost decade. Even comparing stock markets we see problems ahead:

Source: Dshort.com

Japan’s Nikkei 225 index is down 78 percent from the peak reached 21 years ago! Our S&P 500 index is down 41 percent from where it was in 2000. I know many people discount the similarities between the two countries but you have many comparisons and the path each country is following is very similar:

-Central banks protect banks and turn them into zombies hiding assets in balance sheetsA big difference is the demographic argument and population growth. Yet I would argue that we have a mini-Japan like issue at hand with baby boomers entering into retirement. You have a wealthier previous generation trying to sell stocks and real estate to a poorer younger generation. No doubt, there will be demand for real estate but what we are seeing is demand for affordable housing, not massive debt built mansions. This is being played out here in the U.S. as there is little sign that we have a massive growing middle class emerging that will supplant the baby boomers. And one thing that we even have worse than Japan is our massive burden of student loans on Americans. The student debt market is now larger than the credit card market here in the U.S. Japan does not have a similar massive student loan market. So that is actually a larger negative that we have that Japan doesn’t. Just because you have a growing population means nothing if you can’t bring them into the middle class. Food stamp participation has shot up 70 percent in the last four years and now one out of every six Americans is on this program. Yet what isn’t brought up is that these were folks once not on food stamps. So we are pulling people from the middle class or the working poor deeper into the inequality and this is causing our system to stall and enforces government policy that simply protects the too big to fail banking sector.

-Incredibly low rates for decades

-Stock market bubble followed by real estate bubble

-Rise of part-time employment workforce

-Drag on GDP

-Massive fiscal deficits

-Artificially low interest rates

-Inflation controlled in government measures

-Large aging populations

-Poorer younger generation

So far we’ve been in this crisis for four solid years and the path seems extremely similar with differences here and there. Japan’s multiple lost decades have hurt its overall economy:

Japan’s GDP growth has stalled since 1995. For the first time since the 1950s has the U.S. had a stall in GPD growth dragging out for four years. How much longer can this go? What similarities or differences do you see between the paths we are following?