I came across an excellent website today and am directly posting from this source.

I will post a few more very interesting articles.

This is a MUST read and hats off to this guy who has analysed it so well.

I would like to recommend you to visit the below site and have a look.

The crisis in housing seems to be leveling off only in the sense that we have grown accustomed to horrible news regarding the housing market for four years. We have developed coping strategies to combat the crushing reality that home prices continue to ebb lower as more foreclosures are pushed through the clogged up pipeline. What is equally disturbing is that young professionals, those 25 to 34 are equally educated as their baby boomer counterparts but with one major distinction. That major distinction is massive debt with college tuition inflation. I bring this topic up because this age group of 25 to 34 is the prime customer group for first home buying. While many baby boomers were able to graduate with little or no debt a few decades ago, that scenario is becoming more and more of a distant memory as public schools choked off of state funding are hiking tuition costs. Here in our state the University of California and California State University systems have been raising tuition in the last couple of years to make up for the cuts in state funding. With little blue collar work that pays well, having a college education is seen as one of the safest paths to the middle class but that path is getting more and more expensive. Potential new home buyers will have to contend with student loans even before taking on a mortgage.

The education of housing

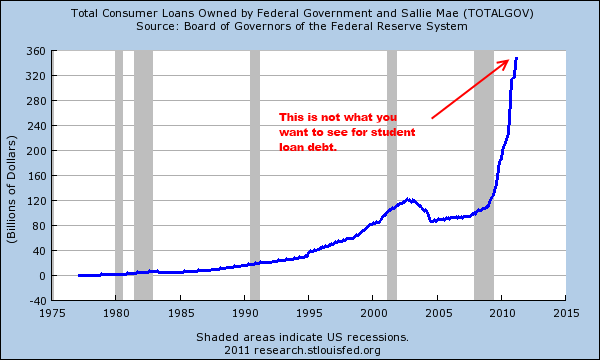

This chart is rather startling and shows only a portion of the Sallie Mae debt portfolio tracked by the Federal Reserve. The above chart does not include all student loans outstanding. Student loan debt has reached $900 billion. The above chart is rather indicative of what is happening in the industry. The rate of growth in student debt is troubling because much of this debt is backed by the Federal government. What checks and balances are in place to audit for-profit schools that operate like subprime lenders in poor communities? This is very troubling and we will crack the $1 trillion mark shortly. And defaults are jumping here as well:

“(Daily Pulse) College may the best years of your life, or it better be, if you’re going to be paying off or defaulting on those student loans well into mid-life. According to a new survey from the Institute for Higher Education Policy, only 37% of students pay back their loans on time; about ¼ of them need to postpone payments to avoid delinquency; and 2 out of every 5 are delinquent at some point in the first five years of repaying the loans. The numbers show education is a priority for Americans—at an estimated $896 billion, total student debt amounts to more than Americans’ credit-card debt—but as the average loan continues to rise ($24,000 last year) along with default rates, how can students know how to weigh the importance of a college education with mounting debt? The Department of Education has proposed regulations to would cut off federal aid to programs whose students graduate with high debt-to-income ratios at for-profit colleges, but what advice should students heed in the meantime?”

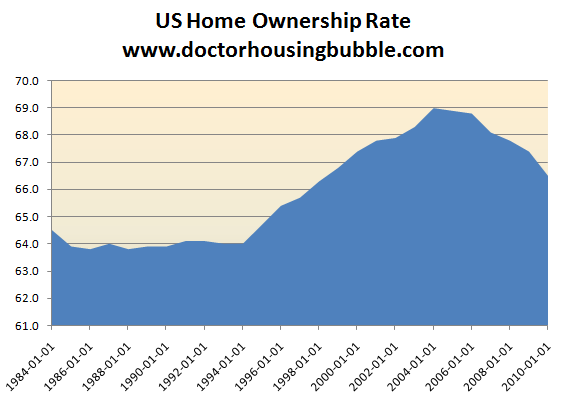

This is problematic on many fronts. Simply by carrying student loan debt a future buyer already is saddled with a monthly payment that will cut into how much “house” he or she can afford. As many lose their homes the home ownership rate continues to move lower:

Source: Census

The current home ownership rate now stands at levels last seen in 1998. Glass-Steagall was repealed in 1999 and allowed for every exotic mortgage idea to proliferate the market during the bubble. As it turns out, we did not increase home ownership in any sustainable fashion and simply set our economy down a tragic path chasing easy profits through flips and other get rich quick ideas. Like Oedipus who later receives the news about his father, the past is coming back to haunt us.

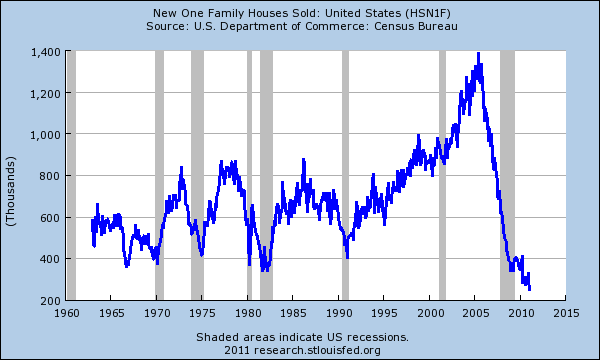

These young professionals who would be prime candidates to buy are typically purchasing from baby boomers that are still intoxicated by the elixir of the housing bubble and many times have unrealistic expectations. This is why many of the homes being sold are actually foreclosure re-sales or investors looking for buy and hold properties at the lower end of the price scale. The new home market which typically catered to this new buyer crowd is crawling at the bottom:

It doesn’t get any lower than that. The answer is rather obvious if the charts could speak to us. Many Americans looking to buy can only afford cheaper priced housing. Saddled with large amounts of debt already, they may not qualify or want to buy a more expensive home. Unlike the baby boomers who had limited debt prior to buying their first home and also entering a healthy economy, we are in a very different situation here.

One of the big pushes to own a home is usually for household formation (aka, making babies). One of the consequences of a deep recession is families holding off on forming households:

“(NPR) The national birth rate fell 4 percent between 2007 and 2009 — more than it had in any two-year period in the past 30 years. With a national average of 66.7 births per 1,000 women between the ages of 15 and 44, nearly every demographic group had lower birth rates, with the sole exception being women over 40.”

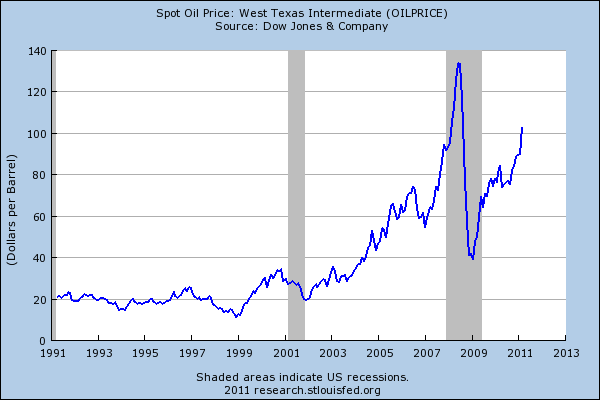

So a young couple may actually be willing to wait until they are on more stable footing. It doesn’t help that other costs like oil and energy are eating up more discretionary income:

The market as we have it right now really resembles nothing like we have had in the past. People think this is normal but it is not. Foreclosure sales and investors are the grease currently moving this market. The move up buyer and first time buyer which usually dominate the market in normal times are actually a smaller part of the mix. In the past you would have a first time buyer purchase a home from someone who would them move up to another home. This was typical. Today you have a “one and done” scenario where someone buys a foreclosure and that is it for the transaction.

The amount of student loan debt is really staggering and as you can see from the Sallie Mae chart above, student loan debt has gone up on a near vertical path. Unlike a mortgage, there is no walking away from student loan debt. With students coming out with $40,000, $80,000, and $100,000 in debt many already have a mortgage before buying a home.

No comments:

Post a Comment